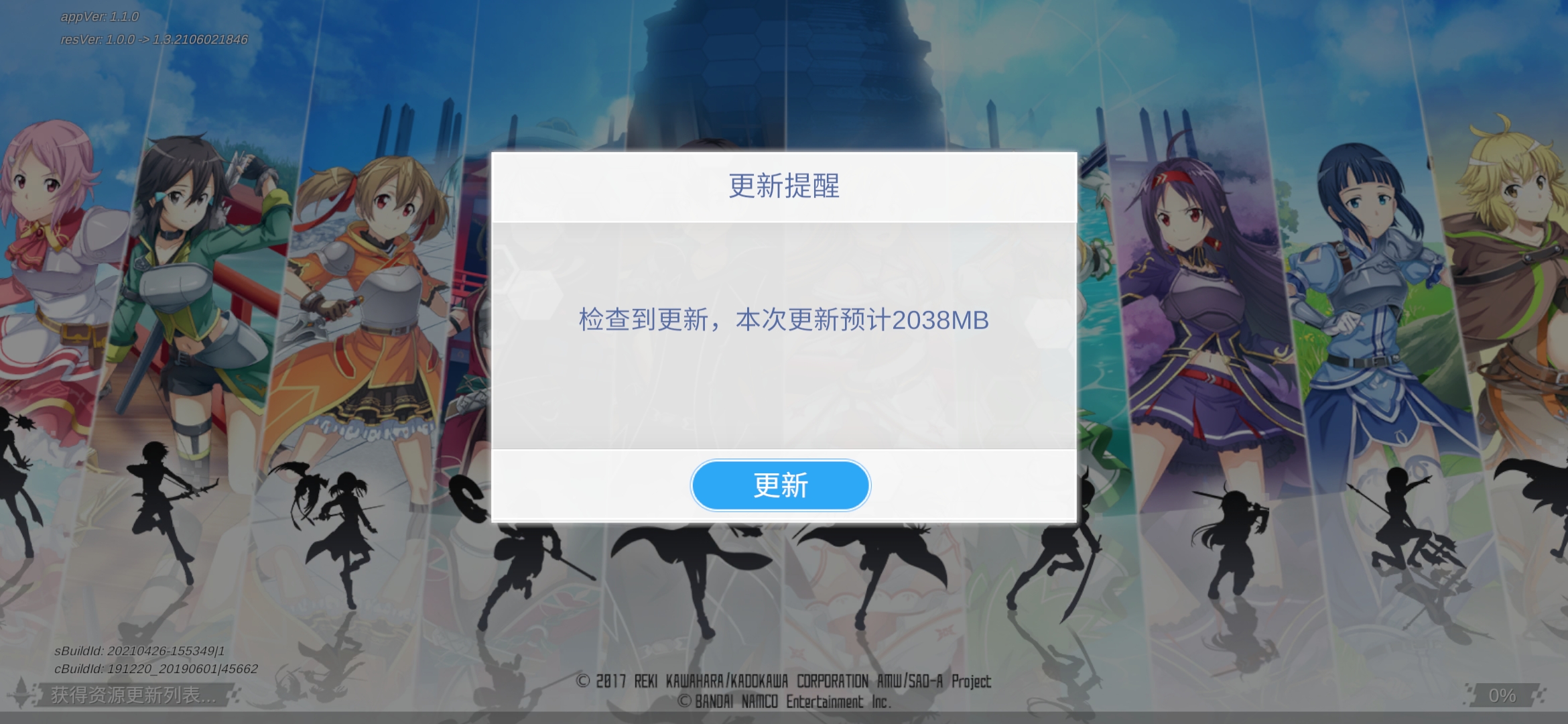

In 2018, they entered into a Joint venture with GREE Inc to develop mobile games in Japan and China.

They first bought an esports team named IM for League of Legends in December 2017 which was renamed Bilibili Gaming. Bilibili is mostly known for ACG-themed mobile games, such as the Chinese version of Fate/Grand Order. In 2018, its revenue from mobile games accounted for 71% of overall revenue which reduced to just 40% in 2020. TapTap is trying to be an alternative to these giant game distributors.īilibili is not only trying to disrupt the traditional game distribution market but it’s also diversifying its revenue streams to take on the likes of Tencent.

#Bilibili hk960m chinese taptap android

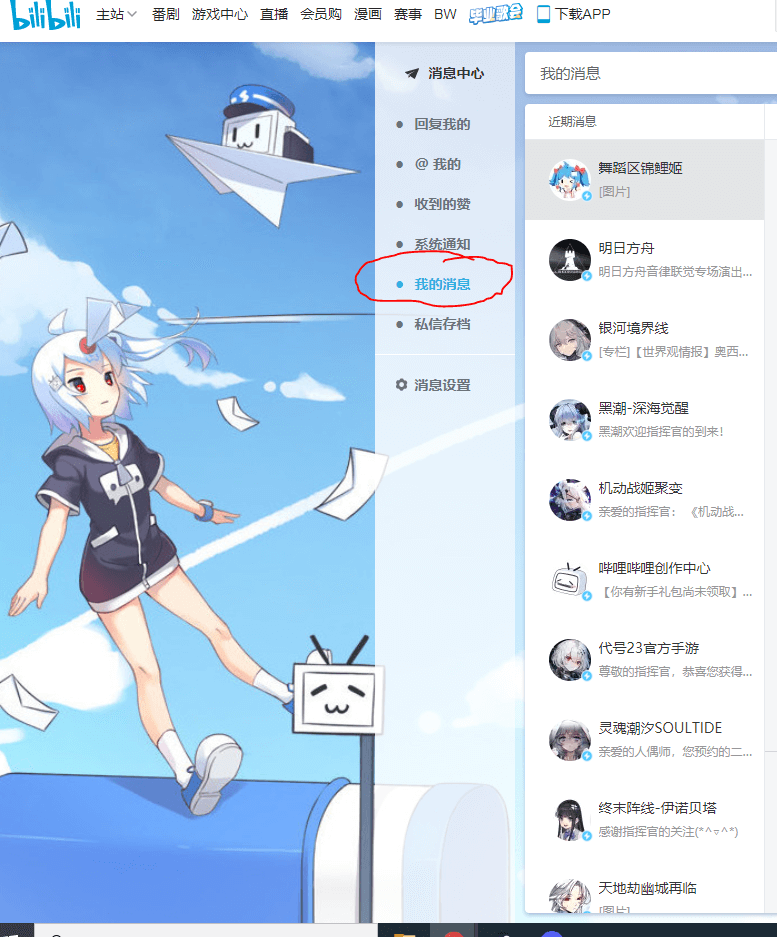

This has tempted not only individual developers but also the likes of Genshin Impact which skipped traditional android app distribution channels. This is totally different from the likes of Huawei, Xiaomi, etc in China (Google and Apple also do the same worldwide) which charges a certain percentage from the developers. TapTap is a platform that doesn’t charge a commission when the payment is made for in-app purchases. To understand how is that even possible for Bilibili to disrupt the market then one needs to delve deep into the matter. Bilibili’s investment in TapTap is being looked upon as a step against traditional app distribution channels.Įarlier, the industry witnessed Epic Games vs Apple fiasco, where Fortnite was removed after it allowed players to buy paid in-game currency bypassing the App Store. Many students like to engage with each other through video comments.Chinese video-sharing website Bilibili has made its stand clear that it intends to revolutionize the game distribution in China with a $123 million investment in TapTap as reported by Tech Crunch. Users are not only using it for the videos, but also for the communities. In fact, Bilibili sees a spike in users every time there’s a major school/university exam coming up.

#Bilibili hk960m chinese taptap free

Educationīeyond boasting a plethora of free documentaries, Bilibili also provides a library of educational videos akin to the quality of LinkedIn Learning. In fact, Bilibili is now competing with players like Tencent Games to launch their own games, as well as bring popular overseas video games to China. Catalysed by the advent of COVID19 bolstering the sector by 30%, Bilibili provides a natural home for many of China’s gamers to post video recordings or even livestream. Technode reported recently that China will be the home of over 450 million eSports players by 2021. The rise of China’s video-game livestreaming activity in recent years has been well documented recently. It is a natural home for China’s perpetually booming ‘ cutesy’ scene. Other popular platforms include Huajiao, Yizhibo, Inke, YY, Momo, Youku and Kuaishou.Īnother major tell-tale difference is apparent when you look at Bilibili’s user demographics.Īs mentioned before, Bilibili’s anime community is one of the largest and most active. As with most East-West platform comparisons, this is a slight misrepresentation.įor one, Youtube has a degree of monopolostic control of video entertainment in the west. By contrast, China’s video and livestreaming industry is incredibly fragmented. We’re seeing a rising number of netizens describing Bilibili as the Chinese YouTube. This week, we'll be exploring the ins and outs of Bilibili its users, it's major categories, as well as best-use examples for brands and retailers. Since 2017, it’s been estimated that at least 80% of China’s internet-active population actively view livestream videos.

Furthermore, China is also blazing the trail in livestreaming technology globally. The rapid uptake of Douyin/Tik Tok is testament to this. However, it's important to recognise that China’s video and entertainment industry has been on the cutting edge of innovation for some time now. This includes a mobile-active userbase of 153 million (+59% YOY).īilibili’s growth this year is, perhaps, a little unsurprising given many of the recent consumer trends stemming from COVID. According to their Q2 statement, Bilibili’s Monthly Active Users (MAU) hit 172 million (+55% YOY). In case you missed it, 2020 has marked the arrival of video streaming platform Bilibili as a major digital player in China's tech scene.

0 kommentar(er)

0 kommentar(er)